It’s been a brutal year for the energy sector, specifically those who make their money in the gas and oil industries. With a couple of weeks left in this year, it could get much worse. In fact, it likely will.

The Paris Climate Agreement will no doubt be one of the most earth-shattering events, if not the most earth-shattering event, in our lifetime. No pun intended. It’s not for the reasons most think though. It’s about so much more than a hashtag and world governments tweeting how they’ve saved the earth. In fact, it has very little to do with those grand gestures, much as they are, but rather, it comes down to what’s going on already, the timing and the folks most affected by the agreement. In fact, for most of us, it won’t mean much of a difference at all. Seriously, I can’t think of a single way that the climate (in the context it’s used today) affects everyday life. Besides, even if I could, there are many who’d argue my way of thinking was wrong. That’s what it is for most of us. Few even bother because everyone is just so sure of what they believe. You can’t change the mind of one who insists the earth is warming no more than you can change the mind of someone who thinks it’s ridiculous silliness. Count me among the latter.

But…ask someone whose bank account is affected. Now that’s an interesting debate!

Just to get an idea of what lies ahead, here are some of the quotes from the past hour or so since the agreement was announced:

Bill McKibben, Co-founder 350.org:

“Every government seems now to recognize that the fossil fuel era must end and soon…Since pace is the crucial question now, activists must redouble our efforts to weaken that industry.”

May Boeve, Executive Director 350.org:

“This marks the end of the era of fossil fuels. There is no way to meet the targets laid out in this agreement without keeping coal, oil and gas in the ground. The text should send a clear signal to fossil fuel investors: divest now.

Facing ‘Keep it in the Ground’ Protest, Feds Halt Fossil Fuel Auction Coinciding With Paris Climate Talks https://t.co/jvF9gQkrqA

— Chris Naven Pearce (@Wynjym) December 11, 2015

//platform.twitter.com/widgets.js

Sanders: Paris climate pact ‘goes nowhere near far enough.’ He wants to stop all new oil, natural gas and coal development on public …

— votewire (@votewire) December 12, 2015

//platform.twitter.com/widgets.js

Believe me when I say it – there’s not a single oil executive who’s not ready to come unglued.

Will there still be shale oil & gas fracking in the US & oil & gas exports, after this climate deal? I doubt it.

— FrackingTestSubject (@gardencatlady) December 13, 2015

“There is no way to meet the targets w/out keeping coal, oil and gas in the ground.” #ParisAgreement #climate https://t.co/cR1hUz3rXV @350

— Sarah van Gelder (@sarahvangelder) December 12, 2015

//platform.twitter.com/widgets.js

I’ve said all year that the fourth quarter was going to be brutal. It doesn’t take a rocket scientist to know that much. Even if the oil industry wasn’t limping along, there was one dynamic that many denied, but was as obvious as a pimple on a 16 year old homecoming queen’s nose: Obama was hellbent on ensuring climate change comes full circle while he’s still in office. And why not? He’s annihilated everything else he’s touched. It makes sense that he’d bet his Nobel Peace Prize on forcing climate change. He’s even taking complete credit for it:

Today, the American people can be proud — because this historic agreement is a tribute to American leadership.

You can read his statement in its entirety here.

So where does that leave gas and oil? Well, considering the losses in recent weeks, especially after the recent OPEC meeting, things are looking as dark as the oil out of the ground. But let’s start with the MLPs. Specifically, let’s start with the MLP that is no longer an MLP. Kinder Morgan was the master limited partnership darling. Up until hours before the giant announced it was cutting its dividends by a whopping 75%, there were folks still singing its praises, certain the moon would fall from the sky before the dividends would be cut. Y’all watch out for that falling moon.

It’s now obvious that the MLPs are indeed exposed to the same threats as any other company in the sector. The threats just appear differently. It’s because everything is so intertwined. But a -42% YTD? That’s worrisome.

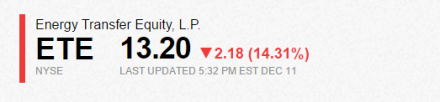

Then, we had the humongous and inexplicable 2 million units of Energy Transfer Equity, valued at more than $34 million, that was bought by the four head honchoes this week. The company’s CEO, Kelcy Warren, bought the vast majority – $32 million. It helped nothing. We’re talking double digit losses in a single day:

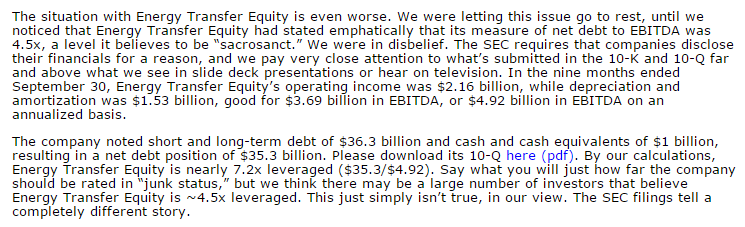

This article from Brian over at Valuentum Securities hits on Friday. There are more than a few unhappy folks. Someone’s lying. If nothing else, download the 10Q and run your own math. If you have money in ETE, you have an obligation to know what’s going on with it.

Also last week, we learned there’s a good chance (so we’ve been told) that despite what was said weeks ago – export bans were in place for the long haul – there’s now a possibility that those bans might be lifted. Wonderful news, right? Except for the fact that the Paris Climate Deal pretty much makes it moot.

Well, at least we still have big oil, right? Maybe not. They’re all cutting their 2016 budgets – layoffs and CAPEX. The cuts are big. Chevron especially is taking a hard hit.

Think shale’s the answer? Nah. Not even close. We’re not the only ones fracking. It’s still expensive, despite the advances and while all of this drilling’s been done, with plenty of oil waiting to be pulled from Mother Earth, the race is on to see what happens first: the companies go bankrupt (several have already filed) or the need for the oil materializes. We have a huge glut with barges filling up by the hour.

It’s doubtful the Saudis planned it this way, but the reality is if companies begin fracking again, and considering they’ve found faster ways of accomplishing it, it’s going to run the supply right back up, which starts the cycle again: too much supply, not enough demand.

And finally – let’s not forget the politics. Obama now has to return to the good ol’ United States of America and face the politicians who rely on the oil and gas industries to pad their pockets with dirty money.

Let’s be clear: it’s a slow dance and we are most certainly not leading it.